Equipment Loans

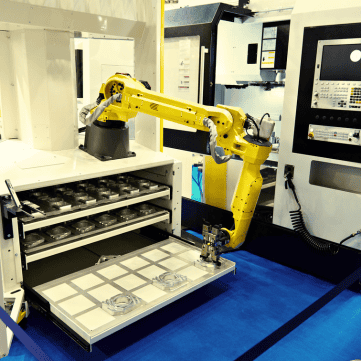

Next to real estate, buying equipment is one of a business’s highest costs. But high-performance equipment can come with high prices. While every business needs equipment, not every business can afford the upfront cost. That’s why smart business owners turn to equipment financing to bring in the equipment their business needs.

• Understanding

Equipment Loans

Long-term equipment loans allow you to manage costs over time while putting that equipment to work for years to come. Short-term loans let you onboard new tech that boosts cash flow so you can pay off the loan quickly. Not sure if new equipment will fit with your workflow? Try an equipment lease and avoid the cost of maintenance and repairs!

• How to effectivly use

Equipment Loans

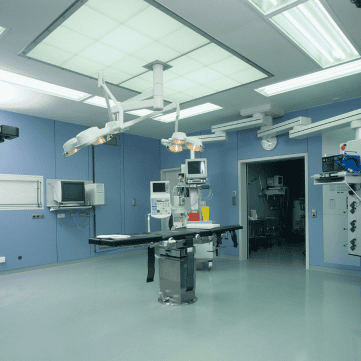

Equipment financing can work for you if you need to buy new equipment or leverage existing equipment to get extra cash. For long-term equipment needs, you can get an equipment loan with a low interest rate. For short-term equipment needs, an equipment lease may be a better fit. At the end of your lease, you can choose to buy the equipment, renew your lease, or surrender the equipment. Leasing fees include maintenance and repair costs.

If you’re happy with your equipment, but need a cash flow boost, a sale-leaseback is the tool for you. A sale-leaseback allows you to sell your equipment while keeping it in place to continue working. You’ll get a cash sum upfront. Then, you make quarterly or monthly payments to the new owner in exchange for using the equipment. If you’re not sure which equipment financing is right for your small business, contact one of our brokers for more information.

SBA

The Small Business Administration encourages lenders to take a chance on small businesses that have been turned down for financing in the past. Get an SBA-back equipment loan at a low interest rate for a 10-year term. Fixed and variable rate loans are available with a 10% minimum down payment.

Private Lenders

Traditional Lenders

Advantages

Manage upfront costs

Short and long-term options are available

Get equipment even with bad credit

Use existing equipment to boost cash flow

F.A.Q’s